Contents

The Qatar car market grew by nearly 35% in 2025, which means an increasing demand for car loans in Qatar. Whether it be applying for a bank credit, trying to get a zero down payment car loan in Qatar, or finding deals for a specific model, let’s see how much time it usually takes to repay a car loan in Qatar, which factors affect the repayment process, and the estimated monthly expenditure for an average loan.

Conditions for bank loans

If you have a constant income and a good credit score, you should first consider taking out a loan with a bank. By the way, a credit score is assessed by the Qatar Credit Bureau and is dependent on factors such as outstanding debts, payment patterns, financial behavior, and credit history. If you aren’t sure about your score, you can request a report on the QCB’s website.

Commercial bank loans vary, as each has its own minimum income requirements and interest rates. For example, the Commercial Bank of Qatar has a minimum salary threshold of QAR 4,000 and charges a 2.49% interest rate. On the other hand, the QNB bank’s minimum income requirement is QAR 2,000, with a 4.25% flat rate and zero down payment.

This also means that the car loan EMI (estimated monthly payment) is mostly dependent on earnings. Another factor is your residence status. Namely, Qatari nationals don’t have to submit a down payment for car financing at the Qatar Islamic Bank, while residents have to pay 20%. In addition, nationals have a higher maximum finance amount and can be much younger when they take out a loan (18 years old), while residents need to be at least 21.

|

Bank loans |

|

|

Loan period |

1–5 years |

|

Down payment |

10–20% |

|

Interest rates |

2.49–4.25% |

|

Eligibility |

QAR 2,000–10,000 salary per month |

Common in-house financing terms

Auto dealerships usually either act as brokers with banks or have their own in-house financing programs. Such options fit the individuals with:

-

Lower incomes

-

Poor credit ratings

-

A car model that’s on promotion

There are no specific eligibility criteria, as loans are tailored to each individual. Furthermore, dealership offers are typically tied to a specific car model, so you should research deals for the car you’re looking for.

For instance, Mannai Autos is currently running a promotion on the Cadillac XT4, which includes a zero down payment policy and a complimentary one-year registration. They also have a similar offer for the Subaru variant, with a zero down payment and 0% interest for two years.

Learn more

Once you take out a car loan, you’ll have to register your car. And for that, you’ll need to insure it. Proper car insurance minimizes additional expenses and allows drivers to focus on repaying their vehicles instead of wasting money on repair bills.

How long it takes to pay off a car in Qatar

In Qatar, it usually takes between 12 and 60 months (one to five years) to pay off a car. Your car loan EMI highly depends on your plan and the cost of the vehicle, but here’s an estimation of the average loan costs:

|

Term (in months) |

Monthly payment |

|

12–24 |

QAR 2,000 – QAR 3,000+ |

|

36–48 |

QAR 1,400 – QAR 1,700 |

|

60 |

QAR 1,200 – QAR 1,500 |

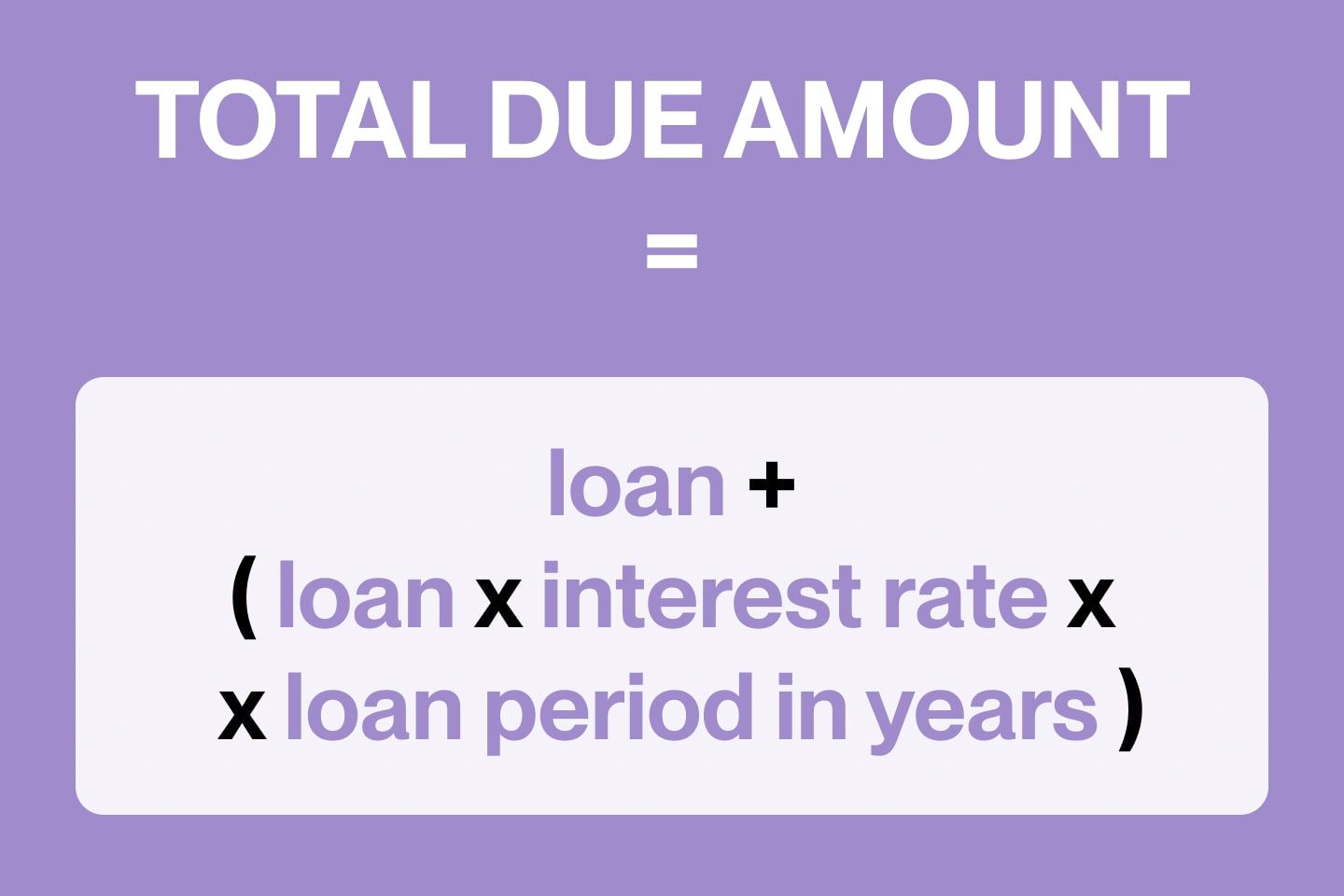

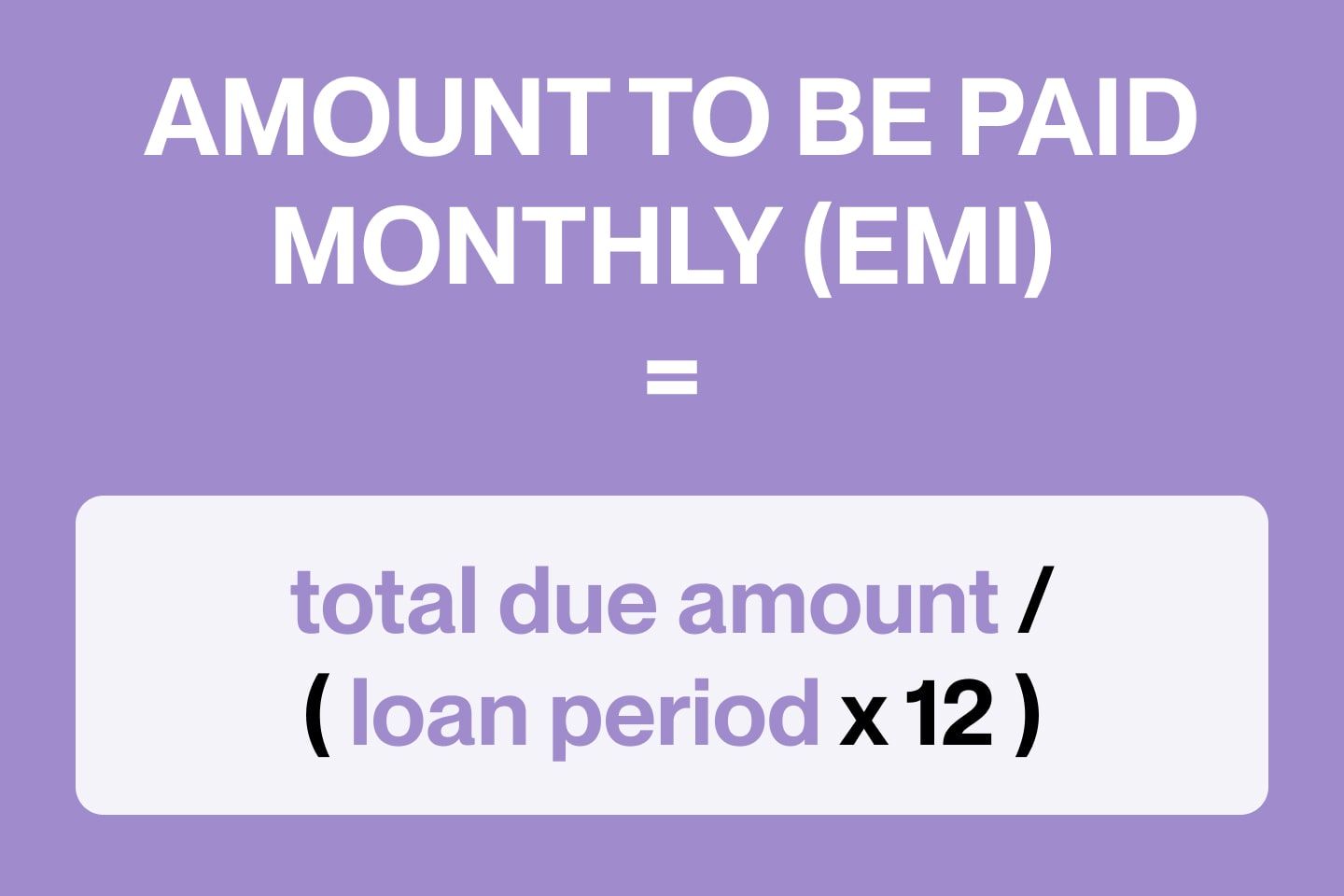

According to current trends, borrowers tend to prefer four to five-year term loans, so that the monthly payments aren’t too high. To help you with estimation, here’s a simple car loan calculation:

Calculating monthly payment:

Example:

-

Loan taken: QAR 80,000

-

Interest: 4% or 0.04

-

Period: 4 years

Total due amount: 80,000 + (80,000 x 0.04 x 4) = QAR 92,800

Amount to be paid monthly (EMI): 92,800 / (4 x 12) = QAR 1,933.33/month

If you want to know what your payments are going to look like over time, request an amortized schedule from the lender.

Trading a used car as a down payment

In Qatar, some dealers will allow you to trade in your old car and use it as a down payment for the new one. This generally comes in handy, especially to those who wish to evade the upfront expenses without securing a zero-down payment car loan in Qatar at inflated rates.

Dealerships will determine the value of your car and take it as a down payment. This typically ranges between 30 and 50% of the loan, which will eventually cut down your installments. But bear in mind that this option is not as common, and it’s likely your vehicle will be evaluated slightly below its actual market value.

Note: The information presented in this article is accurate at the time of writing. Market conditions, interest rates, and bank policies in Qatar are subject to change, and readers are encouraged to verify current details with the relevant financial institutions before making any decisions.

FAQ

Can expats get a loan in Qatar?

What is the minimum salary for a Qatar loan?

Am I eligible for a vehicle loan?

Is a zero down payment better for car loans?

Is it possible to take out a used car loan in Qatar?