Contents

Whether you’re an experienced driver or just starting, understanding full vehicle insurance can help you drive with confidence — knowing you're protected no matter what happens on the road.

Why is comprehensive insurance important and what does it cover

Comprehensive insurance — also known as full insurance — protects your car against a wide range of risks beyond just accidents, such as accidental damage or theft. It allows you to manage the costs of unexpected, expensive losses. It's especially useful if you have a new or financed car, park on the street, or commute every day — situations where both the risk and potential cost of damage are high. Typically, lenders require comprehensive insurance if your car is financed.

Choosing a reasonable deductible allows you to control your insurance premium, while most comprehensive plans include cashless repairs at approved garages — saving you time and money after an accident.

Comprehensive cover at a glance |

||

|---|---|---|

|

Scenario |

Covered under Comprehensive? |

Example / how it works |

|

Accidental damage to your car |

Yes |

Rear-ended at a junction — insurer covers repair costs |

|

Theft |

Yes |

Car stolen and not recovered — payout per insured value |

|

Fire |

Yes |

Electrical fault causes engine-bay fire — repair or total-loss payout |

|

Vandalism |

Yes |

Windows smashed or panels keyed — repaired |

|

Yes |

You damage another car — insurer pays third party |

|

|

Injuries to you/passengers |

Yes |

Medical benefits after a collision |

|

Windscreen/glass |

Often |

Stone chip cracks windscreen — repair/replacement |

|

Storm/flood/sandstorm |

If included/added |

Flash flood damages the car |

|

Courtesy car / roadside assist |

Add-on |

Replacement car during repairs — towing after a breakdown |

|

Illegal driving (e.g., DUI) |

No |

Accident while over the limit |

|

Intentional damage / fraud |

No |

Owner deliberately damages car to claim |

|

Depreciation & wear-and-tear |

No |

Tyres/brakes wear out — value declines over time |

|

Mechanical/electrical breakdown |

No |

Gearbox fails without any insured event |

|

Use outside policy terms |

No |

Using private-use car for paid rides |

|

Unpaved/off-road damage |

No (unless added) |

Damage on rough tracks |

|

Personal belongings in the car |

No (unless added) |

Laptop stolen from cabin |

What is TPL and what does it cover

TPL (Third-Party Liability) is the minimum legal requirement in Qatar. It covers injuries to other people and damage to their vehicles or property if you are at fault.

However, it does not cover repairs to your own car, nor does it protect against theft, fire, or vandalism. If you want coverage for your own vehicle, you’ll need a comprehensive policy or specific add-ons (where available).

TPL may be suitable if you drive an older or low-value car that you could afford to repair or replace yourself, or if you rarely drive.

Here’s how the two types of insurance compare:

| Coverage options |

TPL |

Comprehensive |

|---|---|---|

|

Accidents |

× |

✓ |

|

Personal injuries |

× |

✓ |

|

Third-party liability |

✓ |

✓ |

|

Theft |

× |

✓ |

|

Fire |

× |

✓ |

|

Vandalism |

× |

✓ |

How to choose your comprehensive car insurance plan

When deciding on the right full-coverage car insurance plan and considering additional features, it's essential to weigh several factors. These considerations will help you tailor your insurance to your specific needs:

1. Your vehicle's age and condition

Is your car a new or older vehicle? The state of your car can influence your insurance choices.

2. Your driving experience and habits

Do you drive daily through traffic-heavy areas or only occasionally? If you’re often on the road, especially in busy zones, higher protection might be worth it.

3. Emergency preparedness

It's crucial to have a plan in place for unexpected events. Consider how you'll handle emergencies such as a sudden breakdown in the middle of nowhere.

4. Replacement vehicle needs

If your car is being repaired, consider how you’ll get around during that period. Some insurance plans include temporary replacement vehicles.

5. Off-road or unpaved roads

If your driving often takes you off-road or onto unpaved roads, consider whether your insurance covers accidents that may occur in those conditions.

6. Total loss protection

If your car is financed, make sure your policy includes total loss protection — to cover the difference between the claim amount and your remaining loan balance.

7. Additional policy features:

Explore available policy add-ons to enhance your full car insurance. These can include:

-

Agency repairs — coverage for repairs, typically conducted at insurer-approved shops, often at no extra cost

-

Replacement car — access to a temporary replacement vehicle while your car is undergoing repairs

-

Off-road cover — protection against accidents on rough terrain or unpaved paths

-

Personal accident benefit — provides additional coverage to the driver and passengers in the event of injury, disability, or death

-

Roadside assistance — help with flat tires, fuel delivery, battery jumps, or towing

-

Gap insurance — covers the financial difference between the original purchase price and the total claim payment in the event of total loss of your car

8. Claims assistance

Evaluate whether the insurer offers support with paperwork and the claims process to make the process more convenient for you.

9. Personal driver

Consider whether you need a service that includes tasks such as driving your car to the repair shop and managing paperwork with traffic authorities.

How comprehensive car insurance works

After any incident, make sure everyone is safe and call the police (and an ambulance if needed). Notify your insurer straight away. Take clear photos and note the time, location, and other drivers' details — these make your claim easier to assess.

Your insurer will then decide whether the car can be repaired or should be declared a total loss. For repairs, you pay the policy excess, and work usually goes ahead, cash-free, at network garages. In the event of a total loss, the payout is based on the insured value and policy terms — gap cover (if included) will cover the difference between your purchase price and the remaining loan balance. Many standard policies also exclude damage on an unpaved road and similar circumstances, so always read the schedule and wording of your policy.

How to buy comprehensive car insurance online

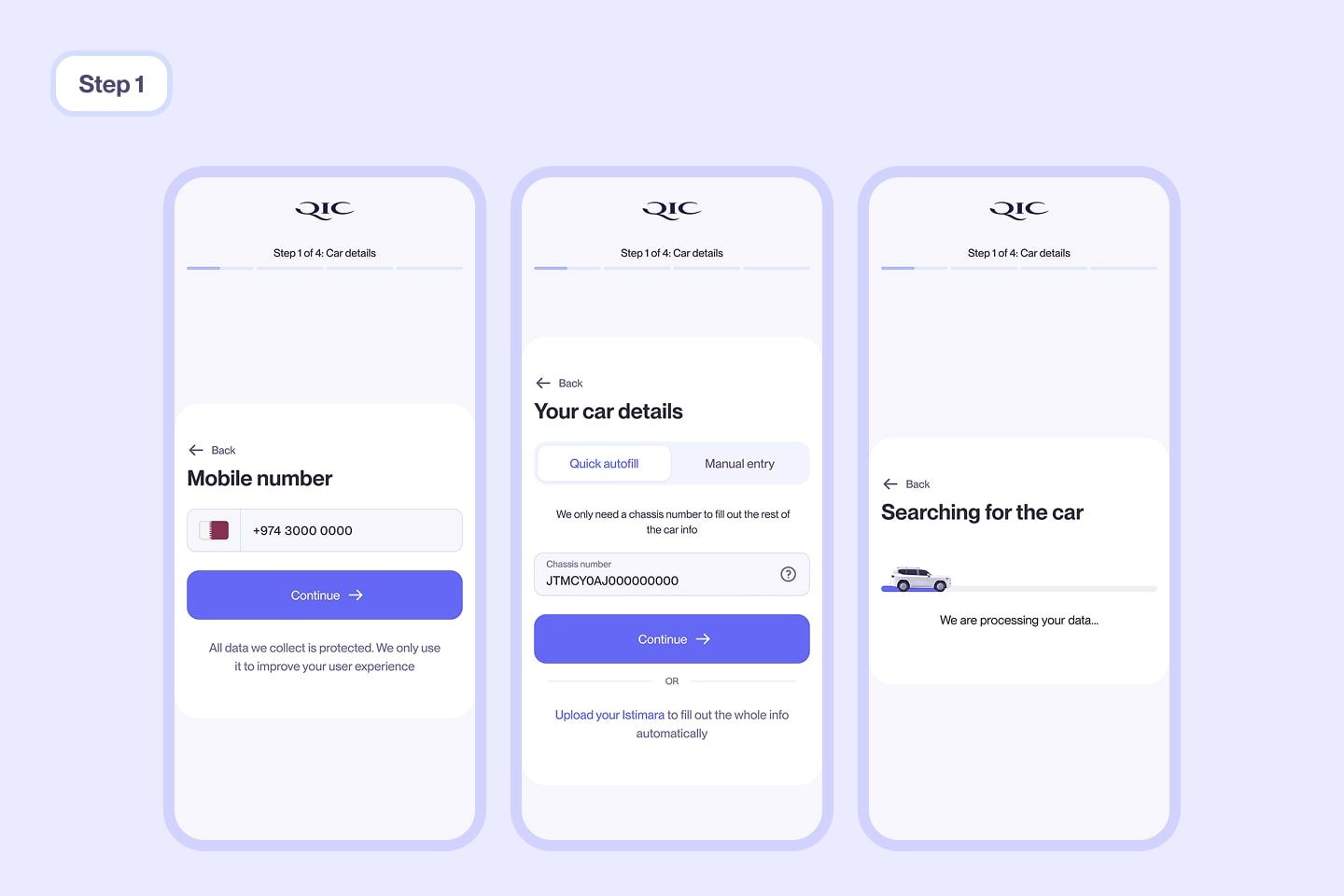

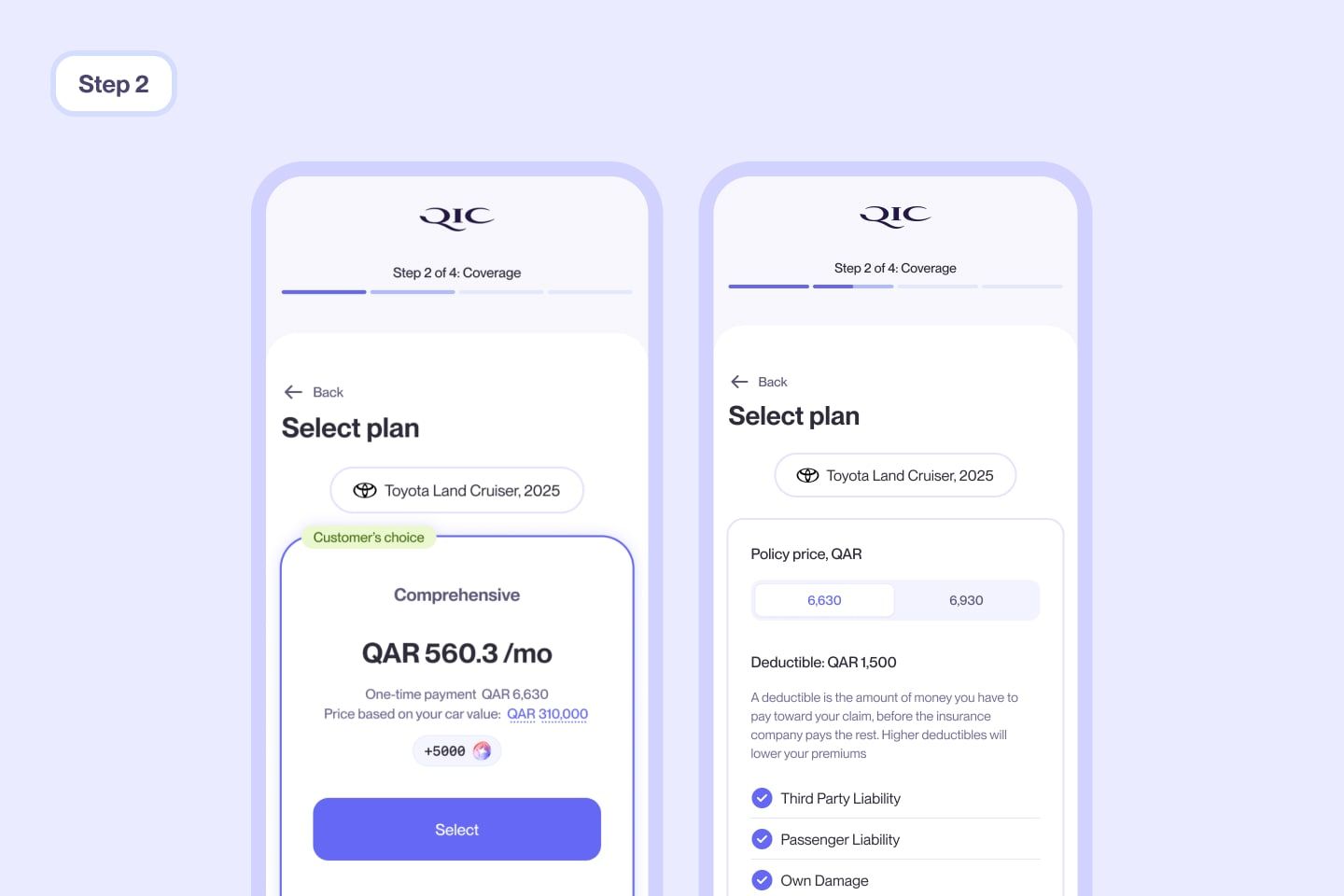

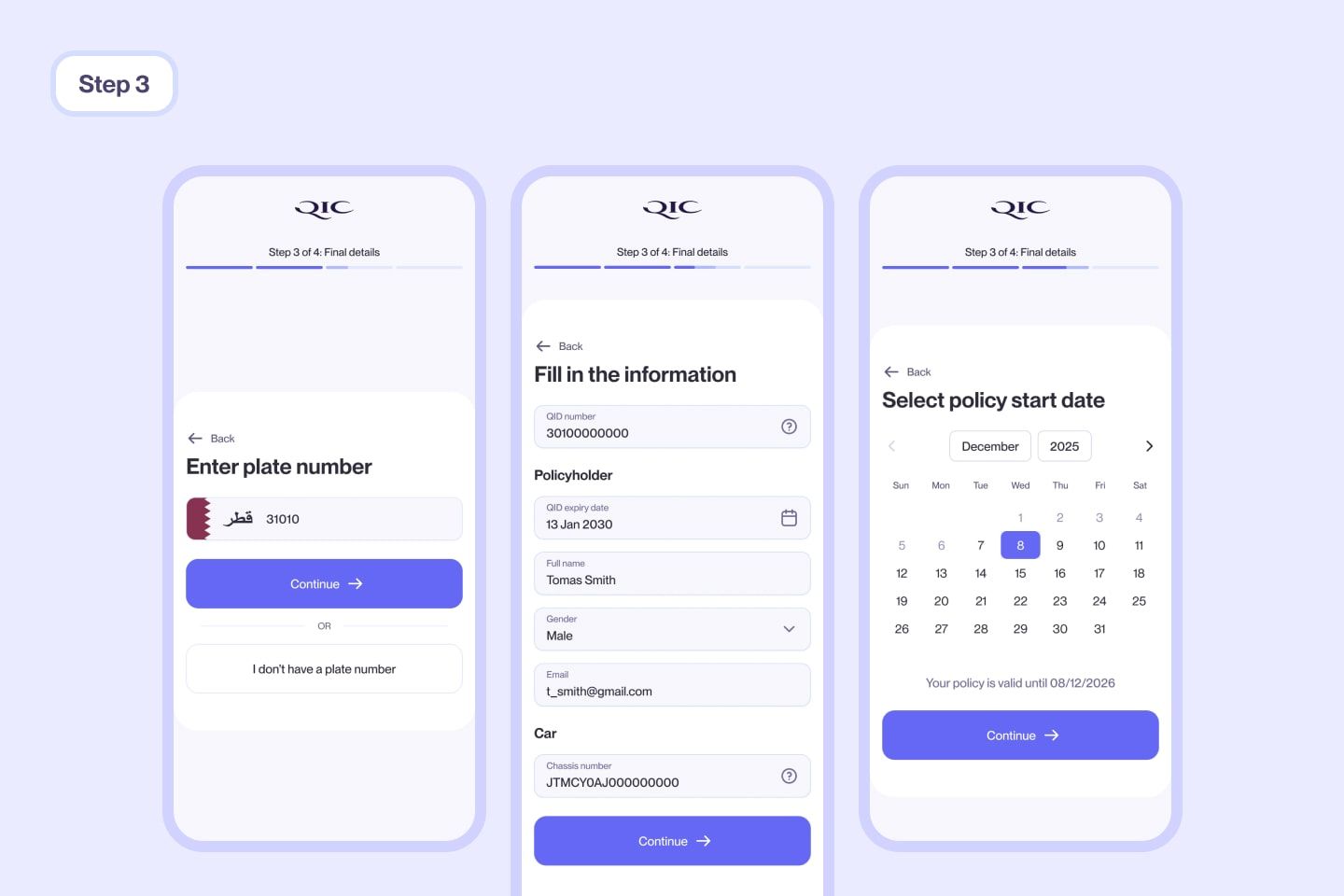

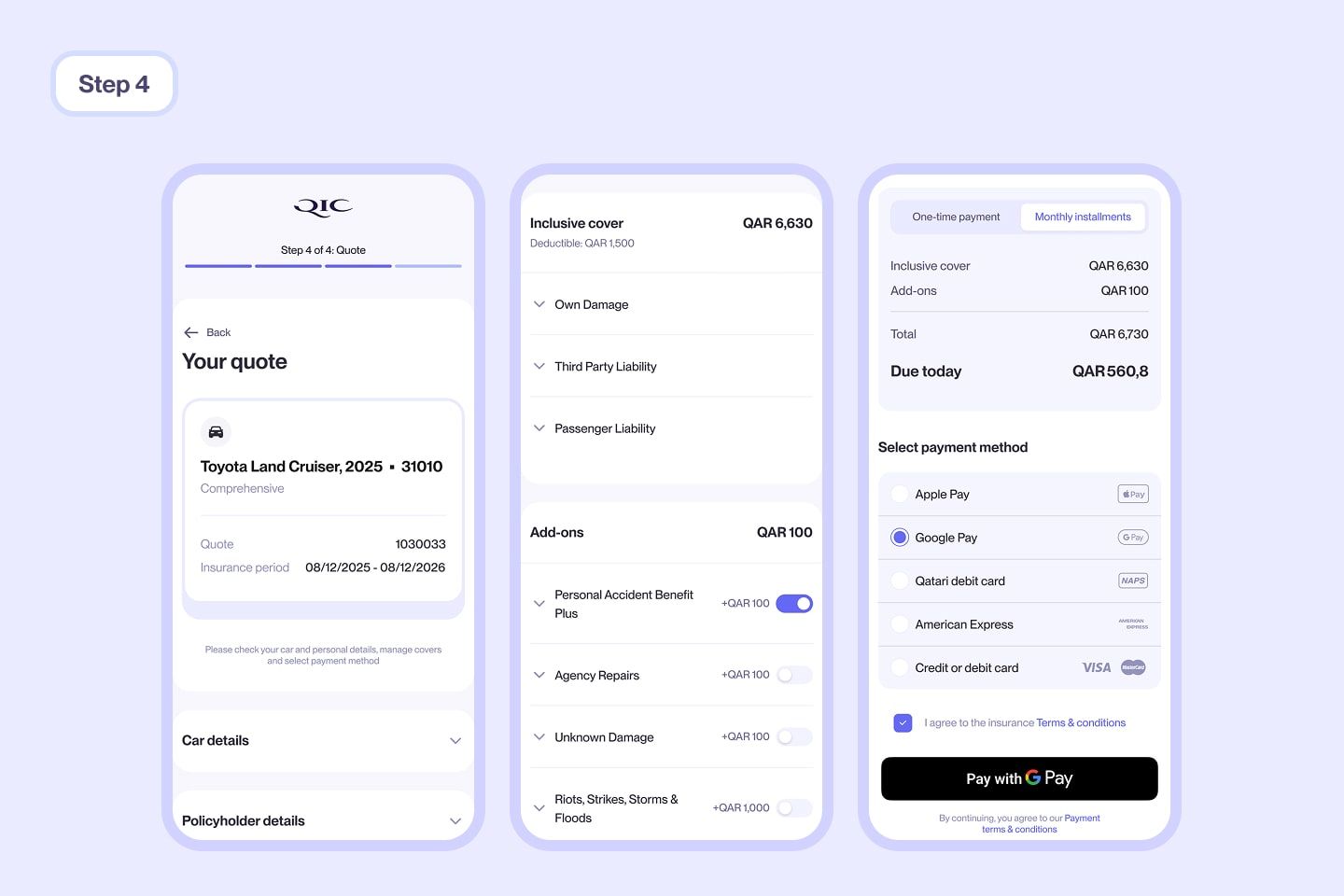

Purchasing comprehensive car insurance from QIC is quick and easy. Simply follow these steps:

1. Go to qic.online and select Car insurance

2. Enter your Qatari mobile number and enter your vehicle's details

3. Select your plan

4. Enter the vehicle's plate number, fill in personal information and your car's chassis number, and select policy start date

5. Review your quote, select add-ons, and make the payment

You are now insured.

How to make an online insurance claim

When you need to make a claim, follow these straightforward steps on our website:

- Access the claims section on qic.online website

- Enter your policy details

- Provide information about your claim

- Upload any required documents

- Your claim is submitted and will be processed once we verify all the details

FAQ

How is my full car insurance premium calculated?

Can I choose how and when to pay my premium?

Do I need comprehensive insurance on an old car?

Is comprehensive car insurance worth it?