Contents

Are you headed for a holiday or on a layover? Do you carry a family visit visa? No matter the reason for your travel, you must have insurance coverage in Qatar. Otherwise, you won’t be able to enter the country. Luckily, buying insurance is simple, and the fastest way is to do it online — no telephones, no waiting, no piles of papers to fill out.

Check if you need it

Travel insurance is deemed a necessity by the Ministry of Public Health for all visitors unless the traveler is a Qatari citizen or GCC resident. Therefore, anyone with a visit visa, family visit visa, or Hayya visa must be able to prove that they have health insurance before they enter the country.

Use approved provider

Qatar will only accept insurance from government-recognized providers. Therefore, while your cousin's high-end UK insurance may sound wonderful, you shouldn’t risk it: purchase travel health insurance from a Qatar-based insurance company.

Qatar Insurance Company has plans specifically designed for visitors that meet the Ministry's criteria. It’s only QAR 50/month, you can purchase it for your whole visa duration, and easily get it online. Furthermore, you receive an instant digital certificate — no emails to chase or phone calls to make, and you’re covered for up to QAR 150,000 for accidents and emergency treatments.

See what’s included

Not all providers offer the same coverage. For example, within Qatar, QIC provides:

-

Up to QAR 150,000 coverage for accidents and emergencies

-

Emergency medical ambulance transport of up to QAR 35,000

-

Repatriation of mortal remains for up to QAR 10,000

-

Medical assistance in both public and private institutions

Get it online

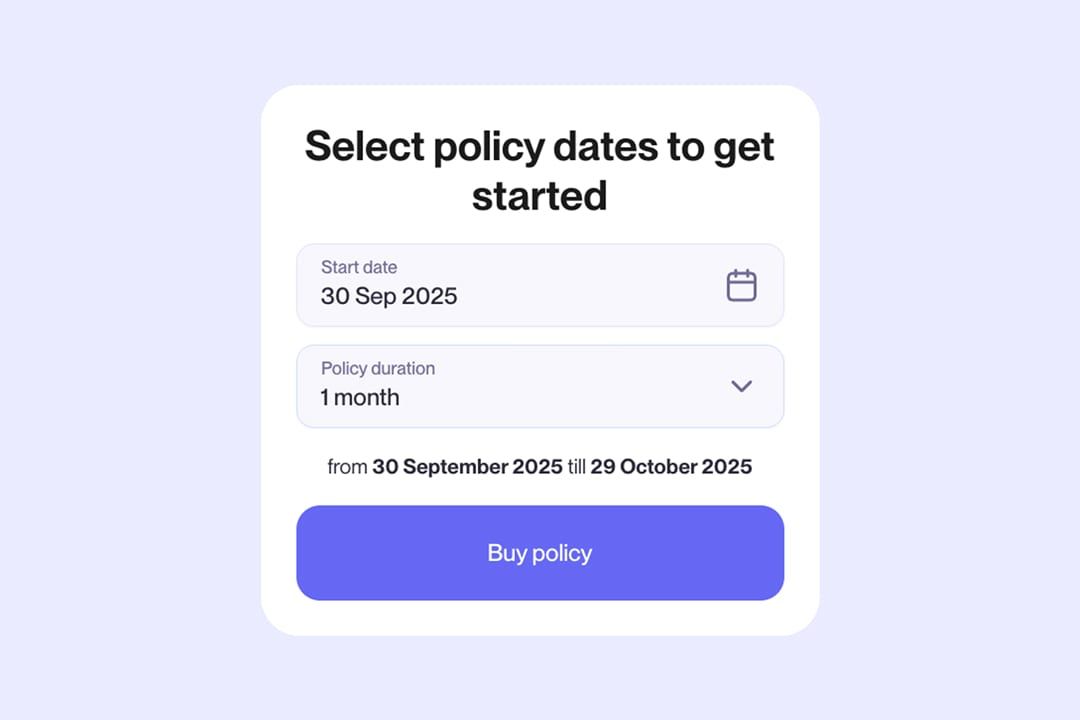

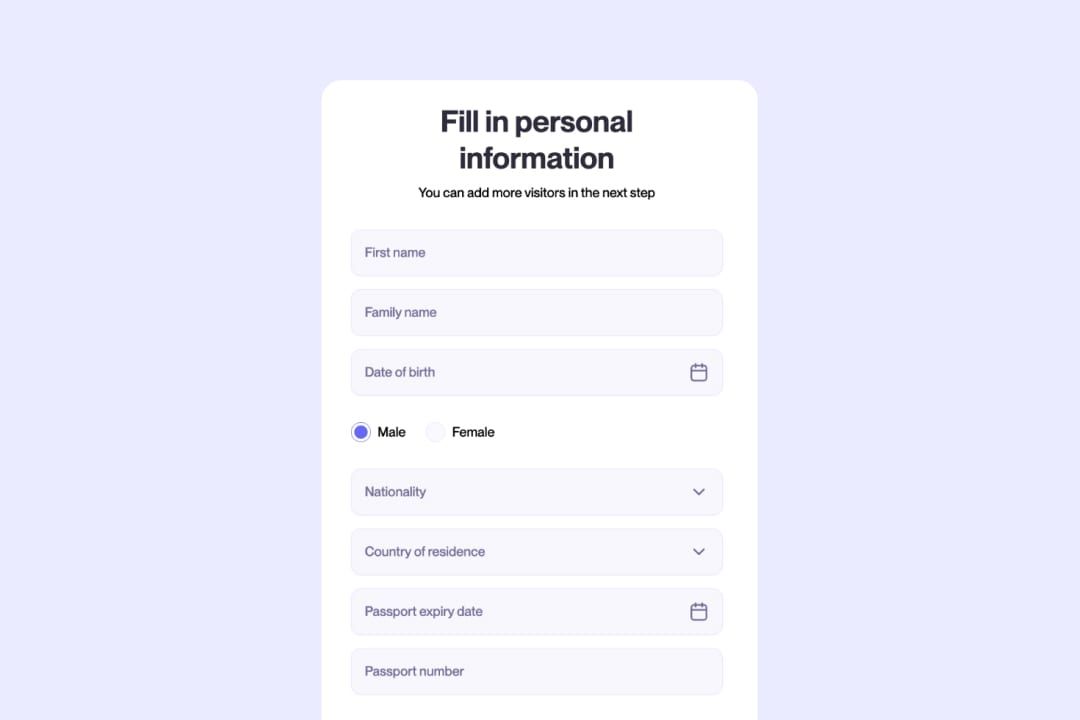

You do not have to go to a branch or call a hotline, and you can get insured while you’re still in your home country. For instance, with QIC, you’ll have to:

-

Go to the Mandatory Visitors Health Insurance section and select your date of arrival in Qatar.

-

Click “Buy policy”.

-

Enter your name, coverage duration, passport number, phone, and email.

-

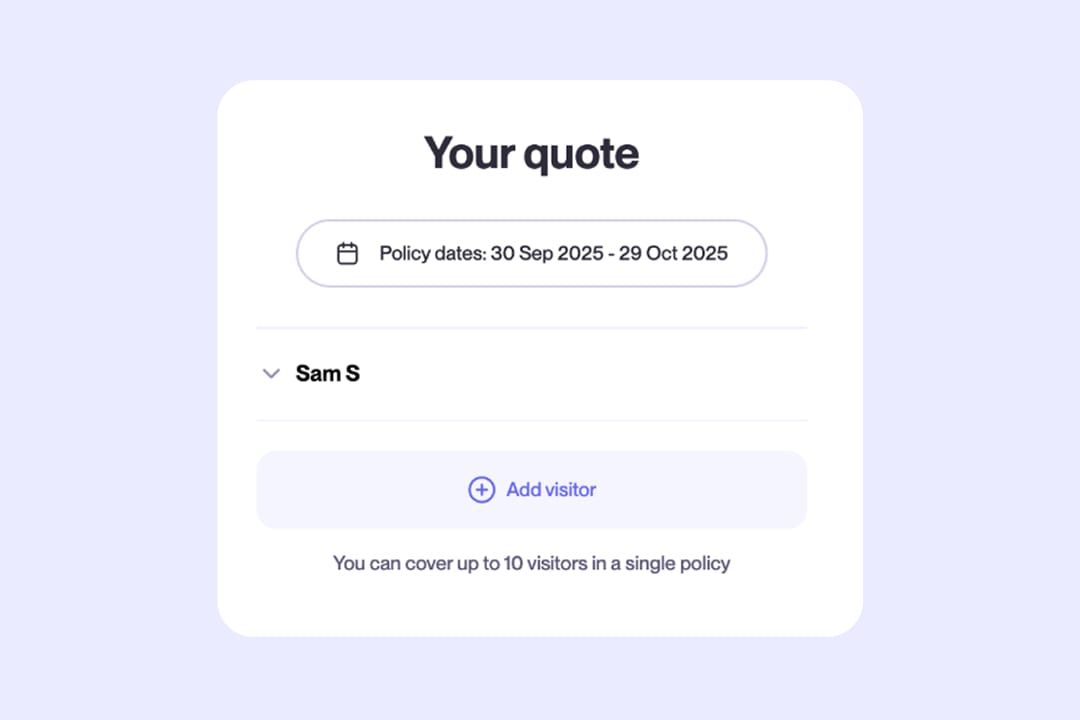

Add up to ten other visitors to your policy.

-

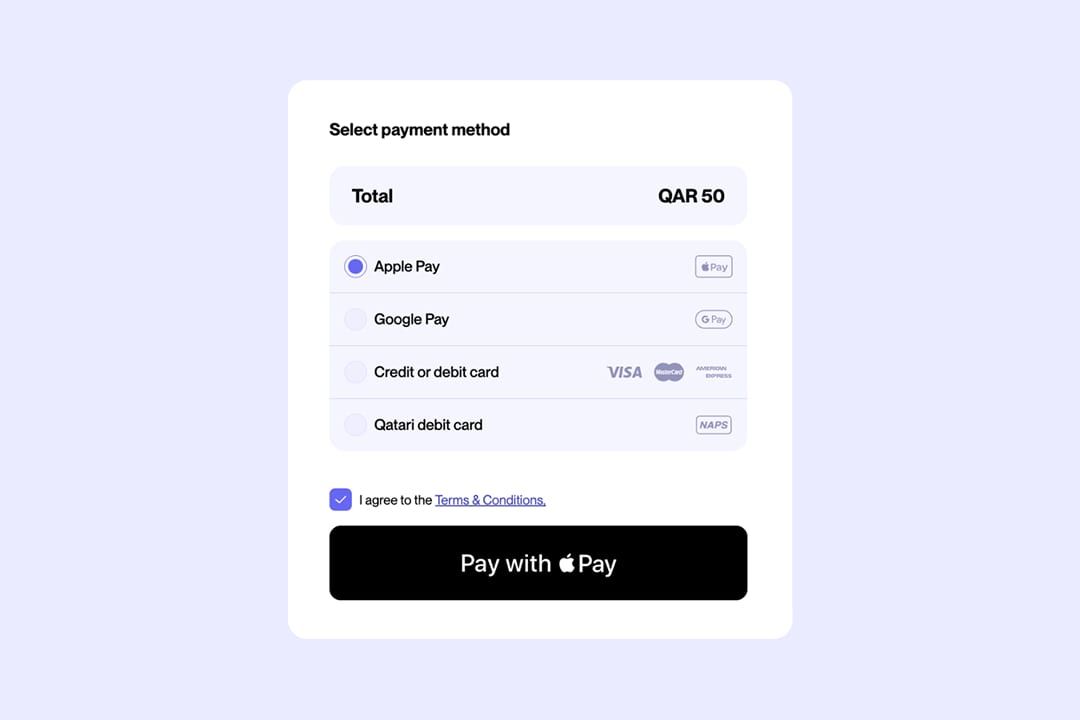

Pay securely using a Google/Apple Pay, debit, or credit card.

-

Download your certificate.

That is all. The entire process takes less than a few minutes.

Renew policy if you stay longer

If you’re staying longer in Qatar, bear in mind — you must be covered for the entire duration of your stay. So, in case you extend your trip, you will need to request a new insurance policy.

Thankfully, you can easily do this online. Simply repeat the steps for getting the Qatar visitor’s insurance, just change the start date to the day after your current policy ends.

What happens if you’re not insured

Since being insured is obligatory, the airport staff has the right to request proof of insurance prior to your boarding or after arrival. Therefore, you will likely be refused boarding by your airline or denied entry at immigration if you don’t have a valid travel insurance, or asked to purchase one immediately.

But, more importantly, in case of an emergency, you’ll have to pay for your medical care. And in Qatar, visitors have to pay for medical treatment even in public hospitals, so not being insured is a serious risk. Therefore, it is not only about complying with state laws, but also about protecting your wallet alongside your health if anything happens to you.

FAQ

Is visitors' insurance the same as Hayya insurance?

How much does it cost to get travel insurance in Qatar?

How much is QIC visitor insurance?

Is healthcare free in Qatar for visitors?

Can I buy insurance at the airport?

Do kids need insurance as well?

Can I add somebody to my travel insurance policy?