Contents

Third-party Liability (TPL) insurance is the mandatory coverage required for all vehicles in Qatar. It covers the policyholder’s liability for accidents, including damages to other vehicles involved in the accident when the policyholder is at fault. Here’s all you need to know about this essential cover.

Why is TPL important

Qatar regulations mandate TPL as the minimum legal prerequisite for vehicle registration. Unlike many other countries, in Qatar, a car cannot be registered without at least 12 months of insurance coverage.

Drivers without insurance may face significant fines and the risk of having points deducted from their driver's licenses, bringing them closer to losing their driving privileges.

While third-party car insurance is affordable, it serves as a safety net against legal complications and financial setbacks in the event of a road accident. It grants you peace of mind even in challenging situations, allowing you to resolve them with ease.

Imagine a scenario where you accidentally damage another car's bumper while exiting a parking lot. Without TPL, such a minor accident could turn into hours of stressful negotiations and potential financial burdens. With TPL insurance, you can address the situation efficiently and avoid significant expenses.

TPL benefits and features

While TPL insurance has limitations, it offers several advantages:

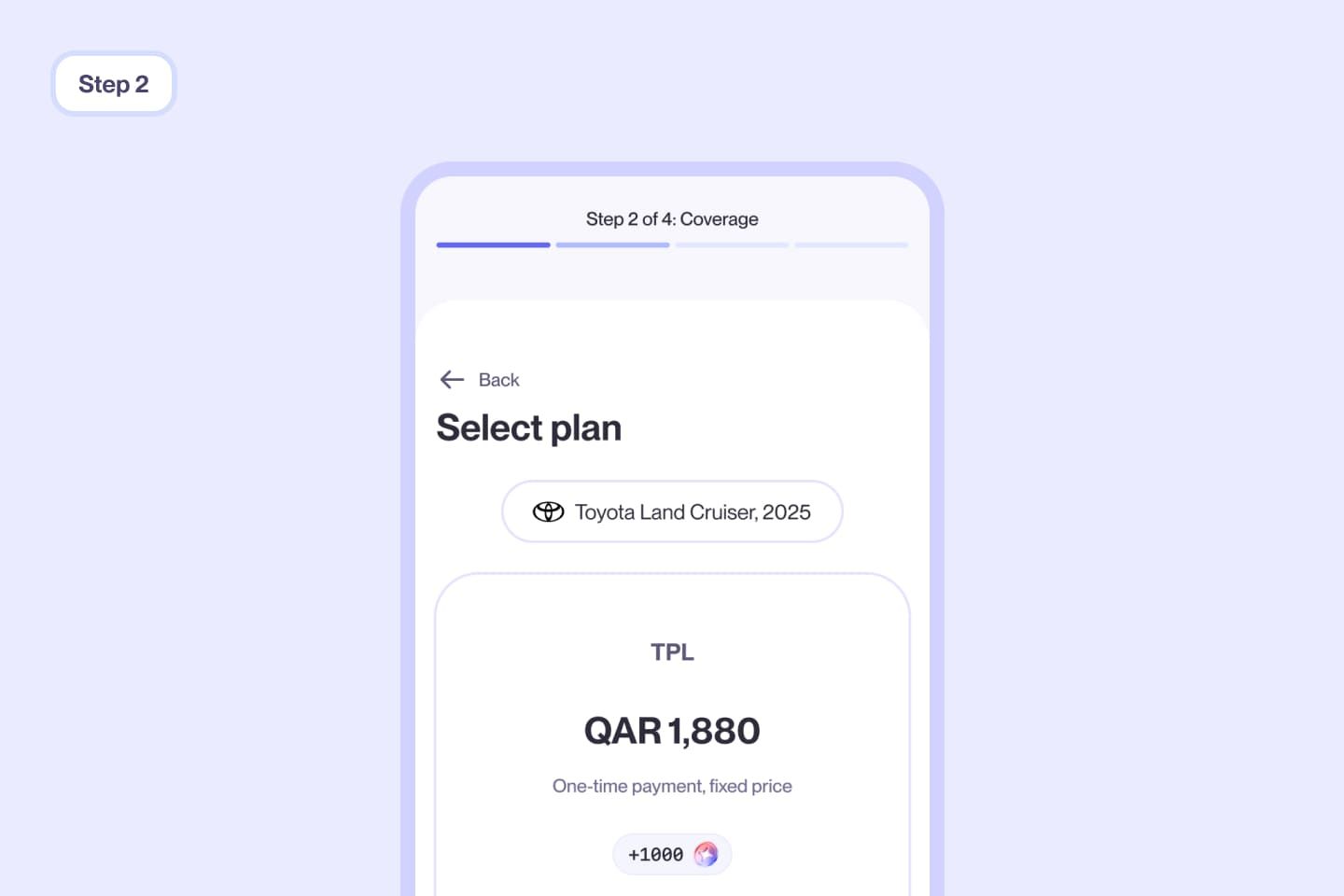

Low premiums: TPL insurance is cost-effective, with annual premiums starting at QAR 400, making it an affordable option compared to comprehensive policies.

Instant insurance: The purchase process for TPL insurance is quick and straightforward, with no complex options to discuss. It can be obtained online within minutes.

Fully digital: The entire process, from obtaining quotes to making payments and filing claims, can be completed online. This convenience saves time and reduces the need to visit insurance company offices.

24/7 claims: QIC provides 24/7 customer service, allowing you to make paperless claims online at your convenience.

Wide presence: With 10 branches in Qatar, QIC can provide quality services wherever you are, ensuring that assistance is always within reach.

TPL and comprehensive cover options

| Coverage options |

TPL |

Comprehensive |

|---|---|---|

|

Damage to your vehicle |

× |

✓ |

|

Damage to the third-party vehicle in an accident caused by you |

✓ |

✓ |

|

Injuries you may sustain in a car accident |

✓ |

✓ |

|

Injury or death of the third party |

✓ |

✓ |

|

Theft |

× |

✓ |

|

Fire |

× |

✓ |

|

Damages to third-party’s property |

✓ |

✓ |

|

Damages due to acts of vandalism |

× |

✓ |

How TPL works

Unlike comprehensive insurance which offers a wide variety of covers, TPL only covers your liability. However, it can prove invaluable in various situations. Let's consider a few scenarios to highlight the protective benefits of TPL insurance:

Passenger liability

In Qatar, third-party vehicle insurance (TPL) provides crucial protection for passenger liability. While TPL primarily covers your liability to other drivers and their property in an accident, it also extends to passengers in your vehicle. If a passenger sustains injuries in an accident for which you are at fault, your TPL insurance can step in to cover their passenger liability per the court's decision. This coverage ensures that both you and your passengers are financially protected in the unfortunate event of an accident.

Collisions

Imagine you’re stopped at a red light and accidentally bump the car in front of you, damaging its bumper and taillights. Even minor repairs can be costly, but with TPL insurance, the other driver can claim directly from your insurer, sparing you the expense.

You, as the insurance policyholder, are considered the first party. The second party is your insurer, and the third party is anyone whose property or person is harmed in an accident you caused. If you’re responsible for a road accident that results in injuries or property damage to other parties, TPL compensates these third parties.

In the event of a collision, notify your insurance company immediately. They’ll access coverage based on the police report and details you provide. Compensation amounts are determined by the judicial system, covering both property damage and passenger liability.

What is not covered by TPL

People often wonder, "Does third-party insurance cover me?" To find the answer, let's explore what TPL does not cover:

| Own damage | TPL does not compensate you for damages to your car caused by accidents, fires, natural disasters, etc. If such incidents occur, you'll need to cover the repair costs yourself |

| Traffic violations | TPL does not cover expenses related to traffic rule violations. This includes situations like drunk driving, running a red light, or crossing double yellow lines. Responsible driving is vital for the safety of all road users, and no insurance covers accidents caused by irresponsible behavior |

| Theft | TPL does not cover losses in case your car is stolen, and the police cannot recover it |

| Willful damage | Intentionally damaging your vehicle to make an insurance claim is not covered. Such claims are not eligible for compensation, and such actions are illegal |

| Fire | Damages caused by fires, such as short circuits leading to fires, are not covered by TPL insurance |

| Man-made calamities | Damages resulting from acts of vandalism or civil unrest are not included in basic TPL insurance |

| Depreciation | TPL does not cover expenses related to the regular wear and tear of your car over time |

| Illegal driving | Damages arising from driving without a proper license, such as accidents involving learner's license holders, are not covered. The same applies to driving without a valid license |

| Natural disasters | Damages resulting from natural calamities like floods or sandstorms are not covered by TPL insurance |

| Car breakdown | Electrical and mechanical breakdowns are excluded from TPL car insurance coverage |

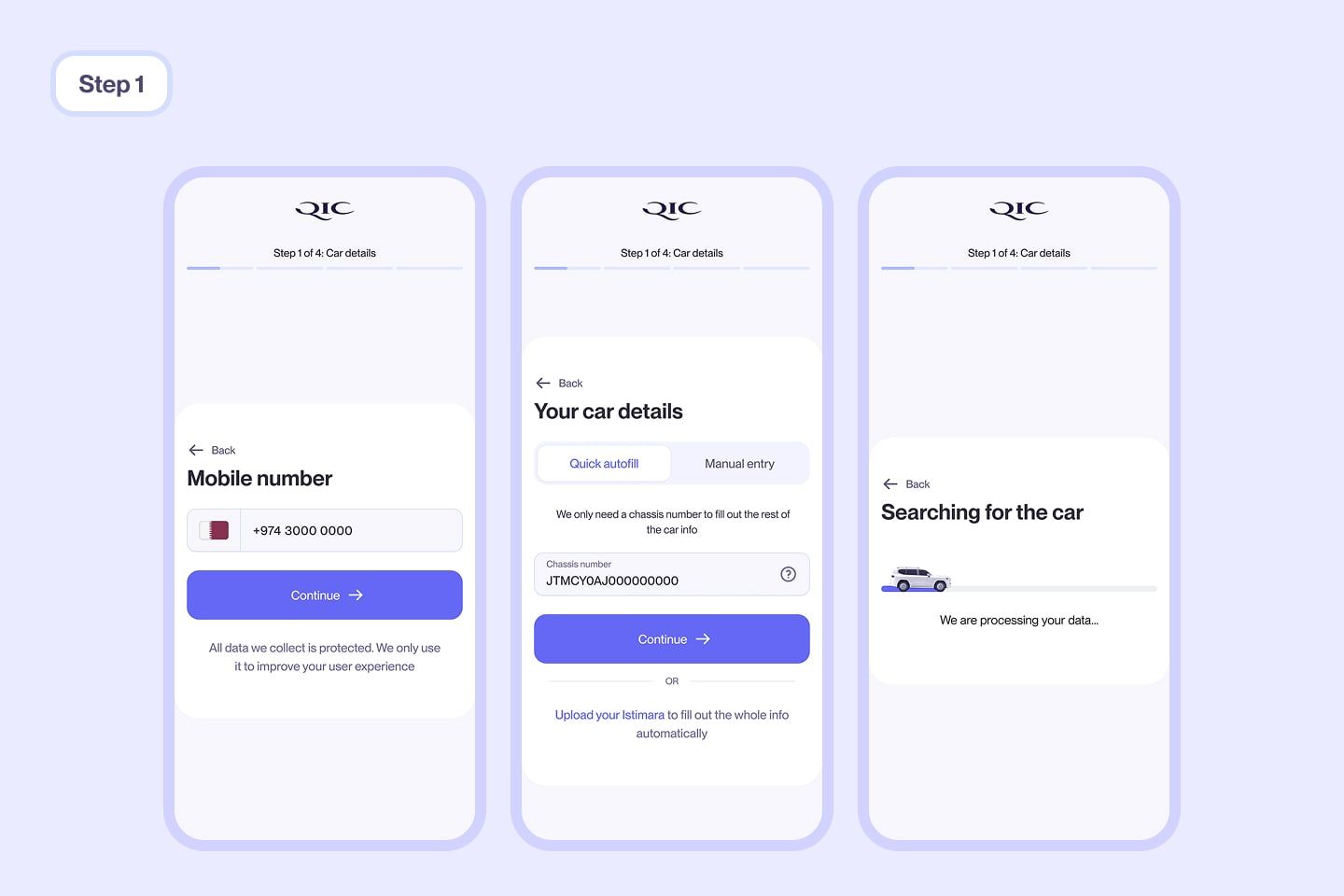

How to purchase TPL online from QIC

If you're interested in buying TPL insurance online from QIC, follow these straightforward steps:

1. Enter your mobile number and car details

2. Select your plan

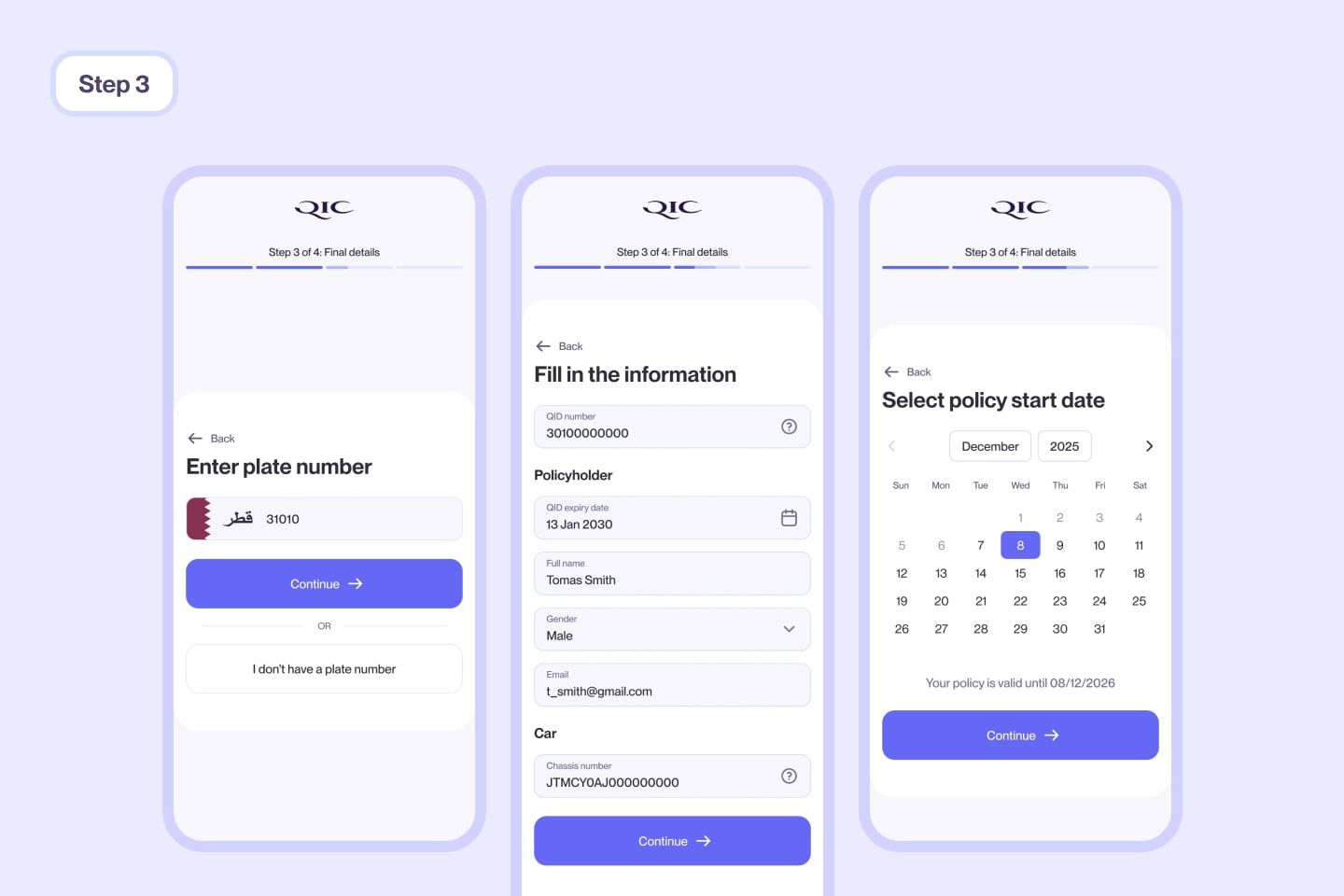

3. Enter your details and select policy start date

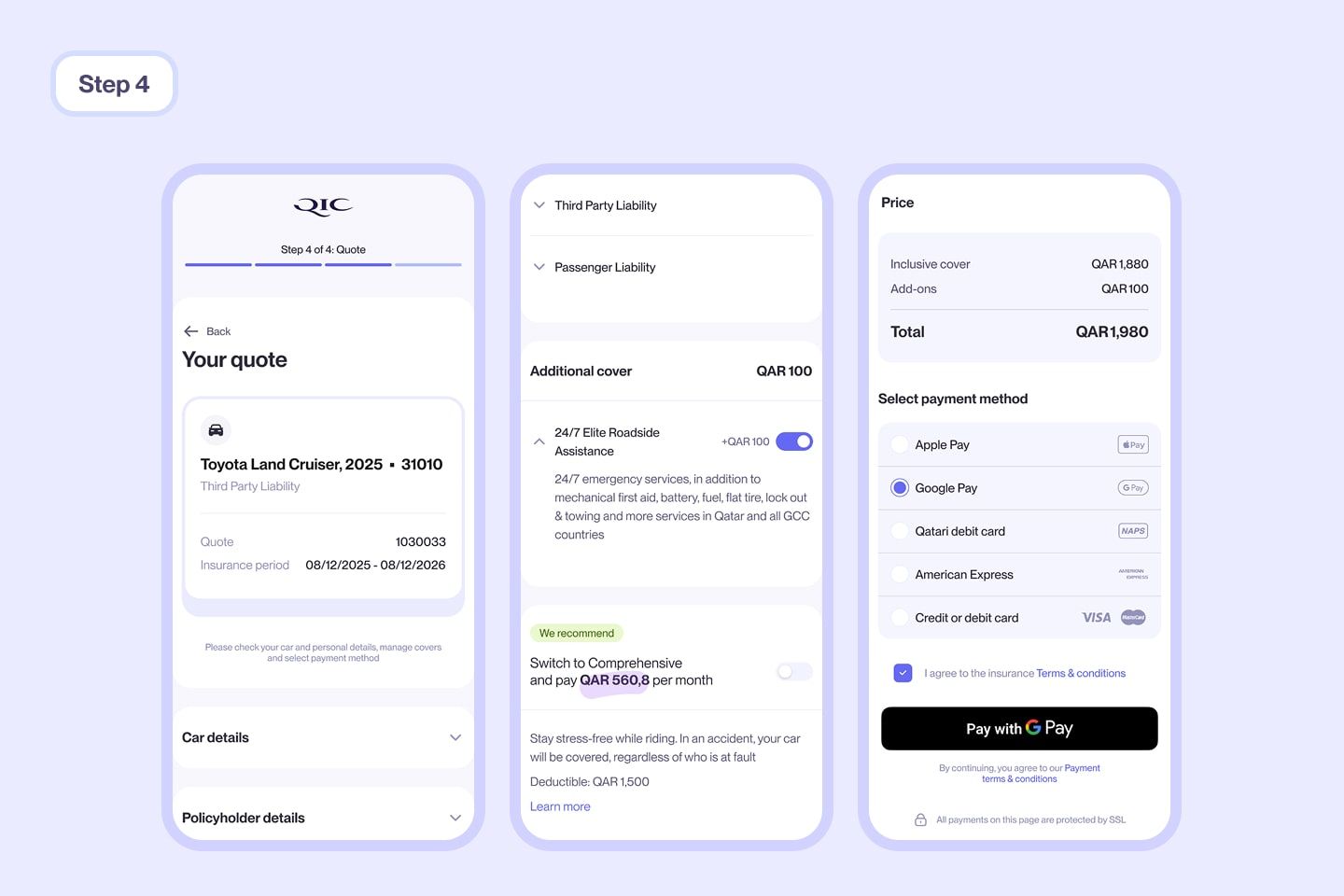

4. See your quote, select any add-ons, and proceed to payment

5. You are now insured with TPL coverage

How to make a claim:

If the need arises to make a claim, you can do so by following these steps:

- Enter your policy details

- Provide the necessary details regarding your claim

- You're all done! Your claim will start being processed

FAQ

Does third-party insurance cover me when driving other cars?

What does third-party vehicle insurance cover me for?

Am I covered by TPL car insurance when driving a rental car?